Introduction

As digital banking reshapes the financial sector, the ability to understand and anticipate customer needs has never been more critical. Today’s digital banks tap into advanced technologies to decipher how clients feel about their experiences, products, and services. Fintech firms like Cane Bay Partners in the Cane Bay Virgin Islands, a fintech consulting firm, support financial institutions in leveraging data-driven insights to better understand customer sentiment and market trends. By converting conversations, reviews, and online interactions into actionable intelligence, sentiment analysis allows banks to respond faster and more effectively to evolving customer preferences.

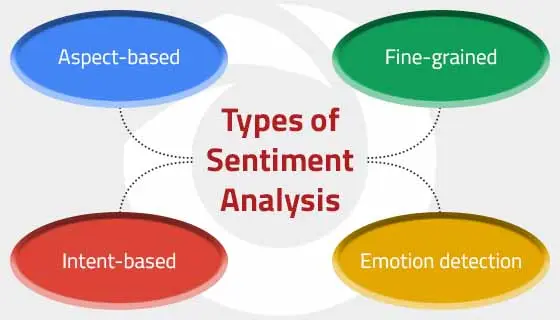

Sentiment analysis, also called opinion mining, employs natural language processing (NLP) and machine learning algorithms to interpret the emotional undertones of textual data. This equips banks with a real-time pulse on public sentiment, enabling them to quickly address pain points, build trust, and maintain a competitive edge in an increasingly digital environment.

The Role of Sentiment Analysis in Customer Experience

Customer experience has emerged as a key differentiator in banking. Traditional institutions face stiff competition from fintech disruptors, making accurate interpretation of the customer’s voice more important than ever. With sentiment analysis, banks can evaluate feedback from reviews, surveys, chats, and social media to identify recurring patterns and pressing concerns.

For example, reviews of mobile banking apps frequently highlight the importance of intuitive interfaces, rapid transactions, and responsive support. Monitoring these sentiments allows banks to implement agile improvements, anticipate dissatisfaction, and deliver personalized client interactions. According to Forrester, challenger banks in Europe surpass traditional banks in customer experience, demonstrating the critical value of sentiment-driven insights.

Personalization Through Sentiment Insights

Consumers increasingly expect personalized experiences in digital banking. Sentiment analysis plays a pivotal role in understanding customers’ preferences, frustrations, and aspirations. When combined with other behavioral and transactional data, sentiment insights enable banks to craft hyper-personalized communications, targeted offers, and tailored financial products.

Industry studies show that 72% of consumers consider personalization a major factor in choosing a banking partner. By incorporating sentiment insights, banks transform generic interactions into meaningful experiences that reflect the customer’s history and needs. Organizations leveraging these strategies see stronger engagement, increased loyalty, and measurable revenue growth.

Enhancing Risk Management with Sentiment Data

Sentiment analysis also strengthens risk management. Banks can monitor brand reputation, detect emerging threats, and identify negative trends across public channels. Sudden spikes in negative sentiment may indicate potential fraud, service outages, or regulatory issues, enabling proactive intervention before problems escalate.

Integrating sentiment data with other risk tools further enhances fraud detection, uncovers adverse behavior patterns, and improves decision-making. This agile, data-driven approach is critical for safeguarding customers and the institution.

Informing Product Development and Innovation

Innovation in digital banking relies on customer feedback. Sentiment analysis directly links customer opinions, offering actionable insights for new features and product enhancements. By systematically analyzing feedback, banks can identify unmet needs, validate ideas, and avoid missteps that might alienate users.

Banks that embed sentiment insights into their product cycles achieve better product-market fit, faster time-to-market, and greater flexibility in testing, iterating, and refining solutions.

Challenges in Implementing Sentiment Analysis

Despite its advantages, sentiment analysis poses challenges. Human language is complex—slang, sarcasm, cultural nuances, and multiple languages can hinder accurate interpretation. Integrating these tools into legacy systems requires technical expertise and careful planning.

Data privacy and regulatory compliance are also critical. Banks must design sentiment analysis programs to align with GDPR, CCPA, and other regulations, protecting sensitive client information while extracting actionable insights.

Future Trends

Emerging technologies promise even deeper capabilities for sentiment analysis. AI, predictive analytics, and real-time data processing allow banks to move beyond simple sentiment categorization toward behavioral and intent-driven insights.

Future applications include integration with chatbots, voice recognition, and augmented reality, helping banks anticipate customer needs and deliver seamless, empathetic experiences. These advancements will make sentiment analysis a cornerstone of strategic decision-making in digital banking.

Final Thoughts

Sentiment analysis is indispensable for modern digital banking, providing insights that drive loyalty, risk management, and innovation. Banks can deliver highly personalized, responsive, and forward-looking services by interpreting customer emotions and perceptions. Financial institutions can harness these insights to stay competitive, agile, and customer-centric in an increasingly digital marketplace with guidance from consulting firms.

Also Read